Apple Pay Statistics [2026]: Usage Trends and Market Growth

Apple Pay now counts 785 million users worldwide, holds 54% of US in-store mobile wallet usage, and processes 14.2% of online consumer payments. This article breaks down adoption by generation, merchant acceptance, market share, and revenue trends shaping Apple Pay’s growth.

![Apple Pay Statistics [2026]: Usage Trends and Market Growth](https://honest-garden-2954e8e7e9.media.strapiapp.com/apple_pay_stats_thumbnail_21b0d86645.png)

Apple Pay didn't exactly take off when it launched in 2014.

Most people stuck to their cards and cash, unsure about paying with their phones. However, the latest Apple Pay statistics show just how quickly this digital payment service is growing.

The service currently has 785 million users globally who tap and pay without thinking twice.

Read on to discover the updated statistics on usage, market share, and adoption.

Key Apple Pay stats

- Apple Pay holds a 54% share of in-store mobile wallet usage in the US.

- The platform processes 14.2% of all online consumer payments.

- 85% of US retailers now accept Apple Pay.

- Gen Z leads Apple Pay usage at 8.8%.

- By 2030, Apple Pay is expected to reach 75.4 million US users.

General Apple Pay statistics

Apple Pay has come a long way since its launch. The digital payment service reportedly had 785 million active Apple Pay users by 2024.

Apple Pay operates in more than 78 markets worldwide and is available on millions of websites, apps, and tens of millions of stores. It’s also supported by over 11,000 banks and network partners.

But things have not always been this way.

Between 2014 and 2021, Apple Pay experienced somewhat sluggish growth. This changed in 2022 when its adoption grew by 41% between that year and 2024.

Apple Pay now holds a 5.6% share of retail sales in the US. A considerable part of this growth (58%) can be credited to the increased merchant acceptance.

Apple Pay adoption and usage statistics

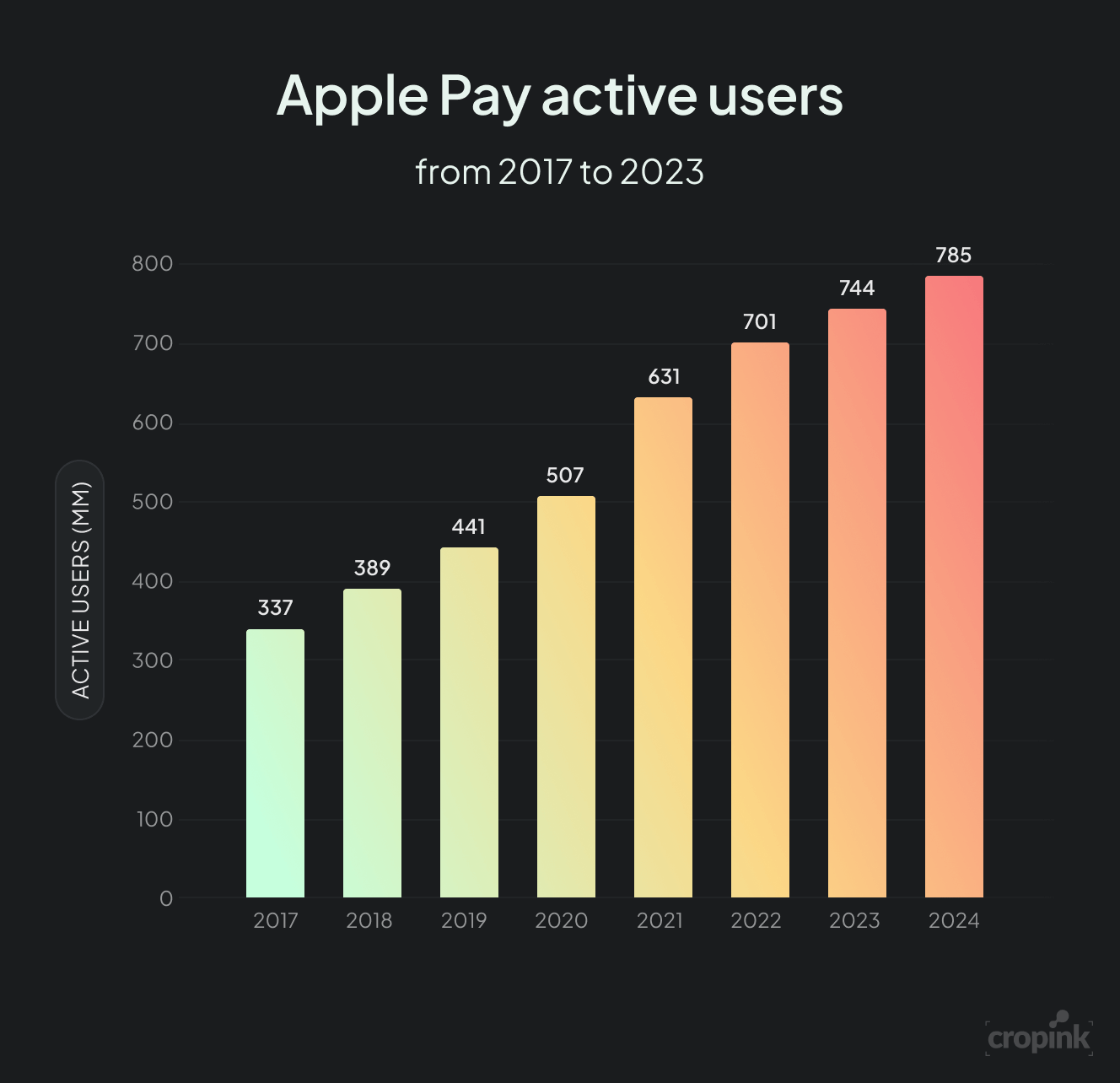

Apple Pay active users from 2017 to 2023

| Year | Active Users (mm) |

|---|---|

| 2017 | 337 |

| 2018 | 389 |

| 2019 | 441 |

| 2020 | 507 |

| 2021 | 631 |

| 2022 | 701 |

| 2023 | 744 |

| 2024 | 785 |

As mentioned, Apple Pay now has 750+ billion active users. And the future looks more promising.

By 2026, nearly one in four US consumers are expected to use Apple Pay.

In other words, 75.4 million people in the US will be using Apple Pay by 2030, which is over 25% of the entire US population.

Customers are also pretty satisfied with the service, seeing that 98% of US customers are likely to recommend Apple Pay to others.

Despite this positive outlook, over 90% of eligible iPhone users have yet to use Apple Pay for in-store purchases.

Interestingly, less than 20% of Apple Pay's growth over the last decade came from new users.

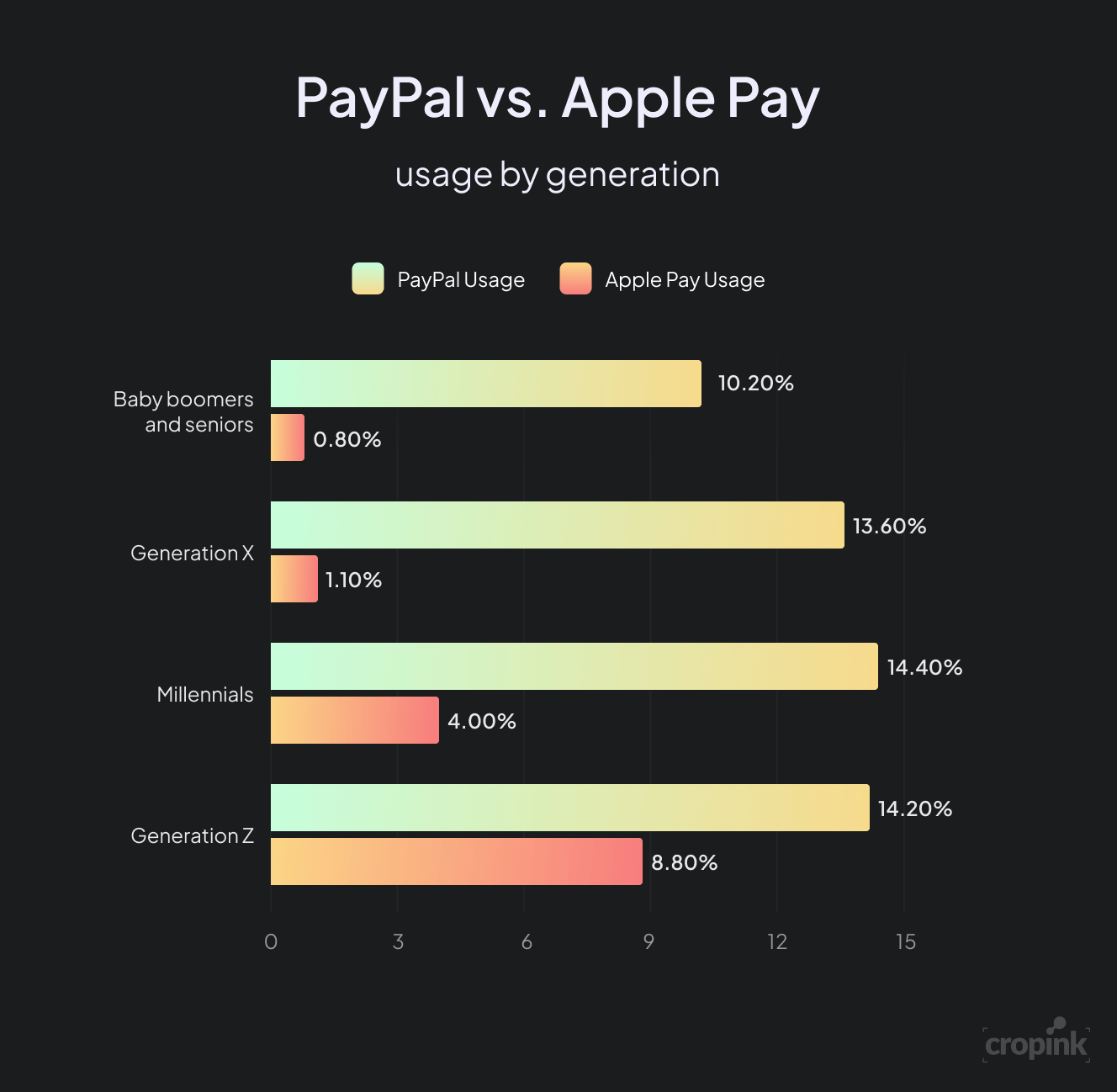

Apple Pay usage by generation

Gen Z has the highest Apple Pay usage (8.8%) among US consumers.

In contrast, millennials show a different preference, with 14.4% favoring PayPal over Apple Pay (4%).

Apple Pay usage drops significantly among older generations, falling to 1.1% for Gen X and just 0.8% for baby boomers and seniors.

Apple Pay statistics: In-person vs. online usage

In a Statista report, 58% of US consumers said they used Apple Pay in-store, in restaurants, or for POS purchases.

On the other hand, 36% of consumers used Apple Pay for online purchases, an increase of 21% from 2018.

Apple Pay is responsible for 14.2% of all online consumer payments and 3.5% of in-store purchases.

Apple Pay market share

Apple Pay is the leader in in-store mobile wallet usage. Our updated Apple Pay statistics show that Apple Pay has a 54% share of in-store mobile wallet usage in the US.

Other mobile wallets (PayPal, Google, Cash App, Walmart, Samsung, Venmo) make up the remaining 46%.

This considerable share can be credited to the widespread adoption by merchants. Statistics show that 85% of US retailers accept Apple Pay.

Which industry uses Apple Pay the most?

Retail businesses make up the largest share of Apple Pay users. They account for 14% of all companies using the service. The fashion sector, manufacturing, and food and beverage industries are also consistent users of Apple Pay.

Notably, mobile debit card payments overwhelmingly occur through Apple Pay, with 92% of such transactions processed via this platform.

How much revenue does Apple Pay generate?

Apple doesn't publicly disclose precise revenue for Apple Pay specifically. However, payment services, which include Apple Pay, generated $24.21 billion in Q4 2022.

In a separate article, the Wall Street Journal revealed that Apple Pay generated $1.9 billion in revenue in 2022 after processing $6 trillion in global transactions. This was only 0.5% of Apple's total annual revenue.

How exactly does Apple Pay make money?

- Fees from financial institutions for network participation

- A small percentage of the transaction value from card issuers

- Developer fees for in-app purchases

- Apple Card revenue, interest charges, Interchange fees, and late payment fees

Apple Pay Statistics: Who are the competitors?

Paypal is the leading digital wallet service in the US with a 35% market share. Apple Pay comes second (20%), and Venmo third with 16% market share. Paypal is used more across generations, while Gen Zs prefer Apple Pay more.

PayPal vs. Apple Pay usage by generation

| Generation | PayPal Usage | Apple Pay Usage |

|---|---|---|

| Baby boomers and seniors | 10.20% | 0.80% |

| Generation X | 13.60% | 1.10% |

| Millennials | 14.40% | 4.00% |

| Generation Z | 14.20% | 8.80% |

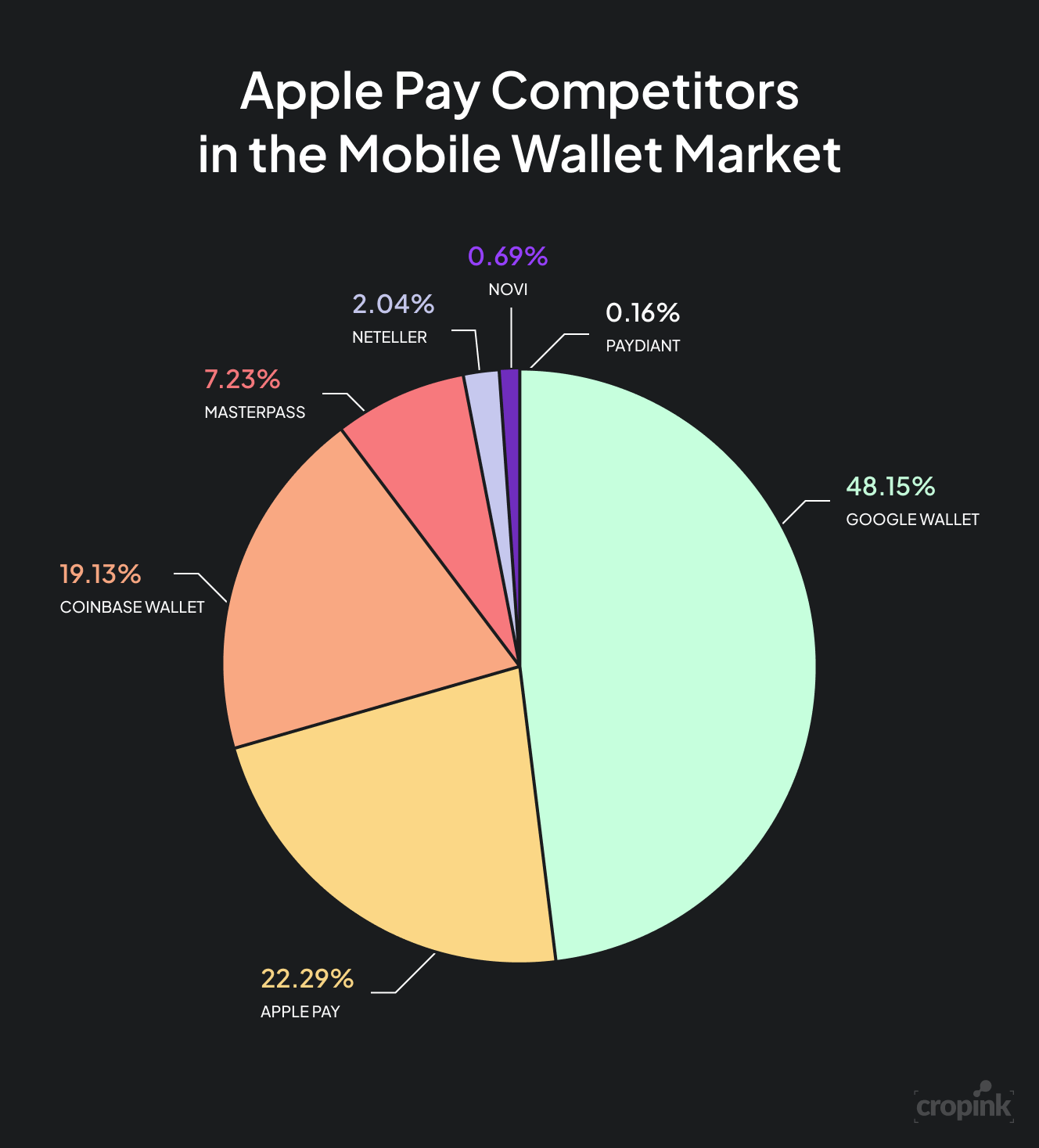

How does Apple Pay stack against other mobile wallet service providers?

Apple Pay ranks second in the mobile wallet market, with a market share of (22.29%). Google Wallet has the biggest market share at 48.15,% and Coinbase Wallet ranks third with a market share of 19.13%.

Apple Pay Competitors in the Mobile Wallet Market

| Technology | Market Share (Est.) |

|---|---|

| Google Wallet | 48.15% |

| Apple Pay | 22.29% |

| Coinbase Wallet | 19.13% |

| MasterPass | 7.23% |

| Neteller | 2.04% |

| Novi | 0.69% |

| Paydiant | 0.16% |

FAQs

Apple Pay has experienced significant growth and is now used by 785 million active users globally by 2024. It holds a 54% share of in-store mobile wallet usage in the U.S. and processed $6 trillion in transactions in 2022.

Apple Pay is available in over 78 markets worldwide, with the U.S. being one of the largest markets, where it holds a 5.6% share of retail sales.

There is no clear indication that Apple Pay is in decline. The service has continued to grow, with adoption increasing by 41% from 2022 to 2024 and 85% of U.S. retailers accepting Apple Pay.

Apple Pay's popularity has surged due to increased merchant acceptance and user-friendly features. It is now responsible for 14.2% of online consumer payments and continues to attract younger generations, particularly Gen Z.

85% of U.S. retailers accept Apple Pay.

Google Pay holds the largest mobile wallet market share at 48.15%, while Apple Pay follows with 22.29%. However, Apple Pay leads in the U.S. for in-store mobile wallet usage.

Wrapping up

The modern-day consumer expects seamless convenience, especially at checkout. Apple Pay delivers on that expectation so well that 98% of users recommend it. For businesses, skipping Apple Pay is skipping the millions of users who have already chosen it, as seen from our updated list of Apple Pay statistics.

Sources

- Business of Apps. Apple Statistics

- Apple Newsroom. Apple Celebrates 10 Years of Apple Pay

- PYMNTS. Apple Pay’s Ten-Year Journey and Its Next Decade of Decisions

- Oberlo. How Many People Use Apple Pay

- Capital One Shopping. Apple Pay Statistics

- AppleInsider. Apple Pay Dominated the World in Just Ten Years – But It Has More Work to Do

- PYMNTS. Preferred Payment Availability Can Reduce Cart Abandonment February 2024

- Statista. Apple Pay Adoption in USA

- Enlyft. Apple Pay

- Apple. Apple Pay

- Payments Dive. Services Such as Payments Boost Apple Revenue

- Wall Street Journal. Apple Pay’s Long Road to Paying Off Is Getting Shorter

- 6sense. Apple Pay Market Share

Damaris is a Digital Marketing Specialist who writes about digital marketing and performance marketing. At Cropink, she creates data-driven content to help businesses run better ad campaigns for better performance and ROI.

Leszek is the Digital Growth Manager at Feedink & Cropink, specializing in organic growth for eCommerce and SaaS companies. His background includes roles at Poland's largest accommodation portal and FT1000 companies, with his work featured in Forbes, Inc., Business Insider, Fast Company, Entrepreneur, BBC, and TechRepublic.

Related Articles

How Can Cropink Help?

Start with Cropink is easy and free

No credit card required