70+ eCommerce Fraud Statistics [2026]: Trends, Data, & Facts

eCommerce fraud is surging—global losses hit $44.3B in 2024 and could soar to $107B by 2029. Discover the latest fraud stats, rising threats like AI scams, and how to protect your online business in 2026.

![70+ eCommerce Fraud Statistics [2026]: Trends, Data, & Facts](https://honest-garden-2954e8e7e9.media.strapiapp.com/ecommerce_fraud_statistics_thumbnail_afbe79fc05.png)

eCommerce fraud is exploding. Businesses lost $44.3 billion in 2024, and by 2029, that number is expected to skyrocket to $107 billion.

Scammers are getting smarter—AI-driven fraud, chargebacks, and account takeovers are costing merchants more every year. If you sell online, you’re a target.

But you don’t have to be a victim. We’ve gathered the latest eCommerce fraud statistics to keep you ahead of the game.

Discover key trends, real numbers, and how to protect your business in 2026.

Key eCommerce fraud stats

- Global fraud losses are rising fast, projected to hit $107 billion by 2029, a 141% increase from 2024.

- Chargebacks will cost merchants over $100 billion in 2025, with 61% of disputes coming from friendly fraud.

- North America accounts for 42% of global eCommerce fraud losses, making it the top fraud hotspot.

- Refund abuse and synthetic identity fraud are on the rise, with fraudulent returns up 48% in 2024.

- AI-driven fraud is growing, with deepfake scams increasing by 28% and synthetic identity fraud surging by 31%.

- Seventy-five percent of eCommerce businesses plan to increase fraud prevention budgets, with 20% boosting spending by at least 20%.

- Biometric authentication is becoming essential, as deepfake and AI scams make traditional verification less effective.

Global eCommerce fraud statistics

Global eCommerce fraud losses are projected to hit $48 billion in 2025, a 16% increase from the previous year.

The rise of online shopping has created more opportunities for fraudsters, making digital transactions riskier than ever.

North America remains the biggest fraud hotspot, accounting for 42% of global eCommerce fraud losses.

The U.S. sees the highest fraudulent transaction volume, with merchants facing increasing threats from cybercriminals worldwide.

Merchants are losing more than just revenue

Fraud is more than a lost sale—it’s a financial drain. For every $100 in fraudulent orders, businesses lose $207 due to chargebacks, processing fees, and operational costs.

On average, eCommerce businesses lose 2.9% of their total revenue to fraud annually.This is an improvement from 3.6% the previous year, but the risk remains high, especially for businesses with weaker fraud prevention systems.

Chargebacks are becoming a billion-dollar problem

Merchants are expected to pay over $100 billion in chargebacks in 2025.

A staggering 61% of these disputes will come from friendly fraud, where customers falsely claim unauthorized transactions to get refunds.

Chargebacks don’t just impact revenue—they increase operational costs. Businesses spend $35 in fraud management for every $100 in chargeback disputes.

Consumers are at high risk

It’s not just businesses taking the hit.

43% of eCommerce consumers have fallen victim to payment fraud, losing money through stolen card details, phishing scams, and fake refund schemes.

With cybercriminals continuously refining their tactics, fraud is becoming harder to detect, leaving millions of online shoppers exposed to financial loss.

Merchants are struggling to keep up

Preventing fraud is a major challenge.

The average eCommerce company now uses five fraud detection tools to mitigate risks.

Despite these efforts, fraud losses continue to rise, proving that current solutions are not enough.

As threats escalate, 75% of eCommerce businesses plan to increase their fraud prevention budgets in 2025.

Companies are actively seeking more advanced fraud detection methods to stay ahead of evolving fraud tactics.

Luxury goods and collectibles are fraud hotspots

Not all industries face fraud at the same rate. Fraudsters are targeting high-value, resalable items at alarming rates:

- Collectibles fraud: Up 106%

- Luxury goods fraud: Up 104%

- Leisure and outdoor product fraud: Up 42%

Meanwhile, industries like business supplies (-48%), beauty (-39%), and alcohol/tobacco (-28%) have seen fraud rates decline.

The shift suggests that criminals are focusing on products with high resale value and lower traceability.

The U.S. and Europe are key fraud battlegrounds

While eCommerce fraud is rising globally, North America leads with 42% of worldwide fraudulent transactions.

The U.S. remains the biggest target, with fraud tactics becoming more sophisticated each year.

Europe is also seeing significant fraud risks, particularly in Germany and France, where online merchants face rising fraudulent transaction rates.

The complexity of cross-border eCommerce and new payment methods are making fraud detection even more difficult in these regions.

Fraud is only going to get worse

eCommerce fraud is surging, and businesses are losing billions. The problem isn’t just growing—it’s evolving, making traditional fraud prevention methods less effective.

With losses climbing and fraud tactics becoming more advanced, 2025 is shaping up to be another high-risk year for online merchants and consumers alike.

Types of eCommerce fraud

Fraud is evolving—and merchants are paying the price.

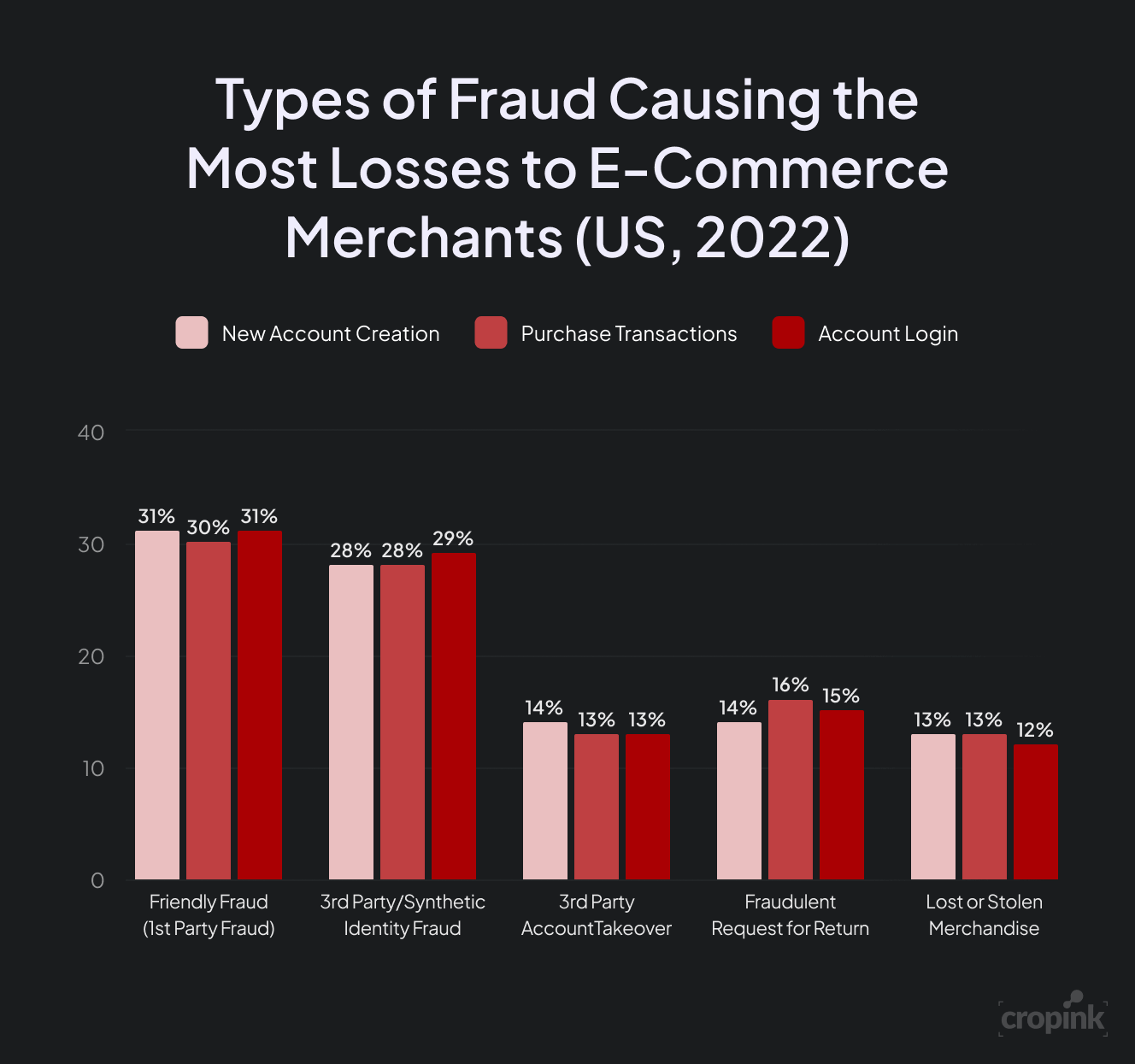

In 2022, friendly fraud (first-party misuse) accounted for the largest share of fraud losses among U.S. eCommerce merchants. Customers would make a purchase and later dispute the charge to get a refund—often after receiving the product.

Synthetic identity fraud ranked second, where criminals created fake identities using stolen personal data. Fraudulent return requests followed, adding to merchants’ financial strain.

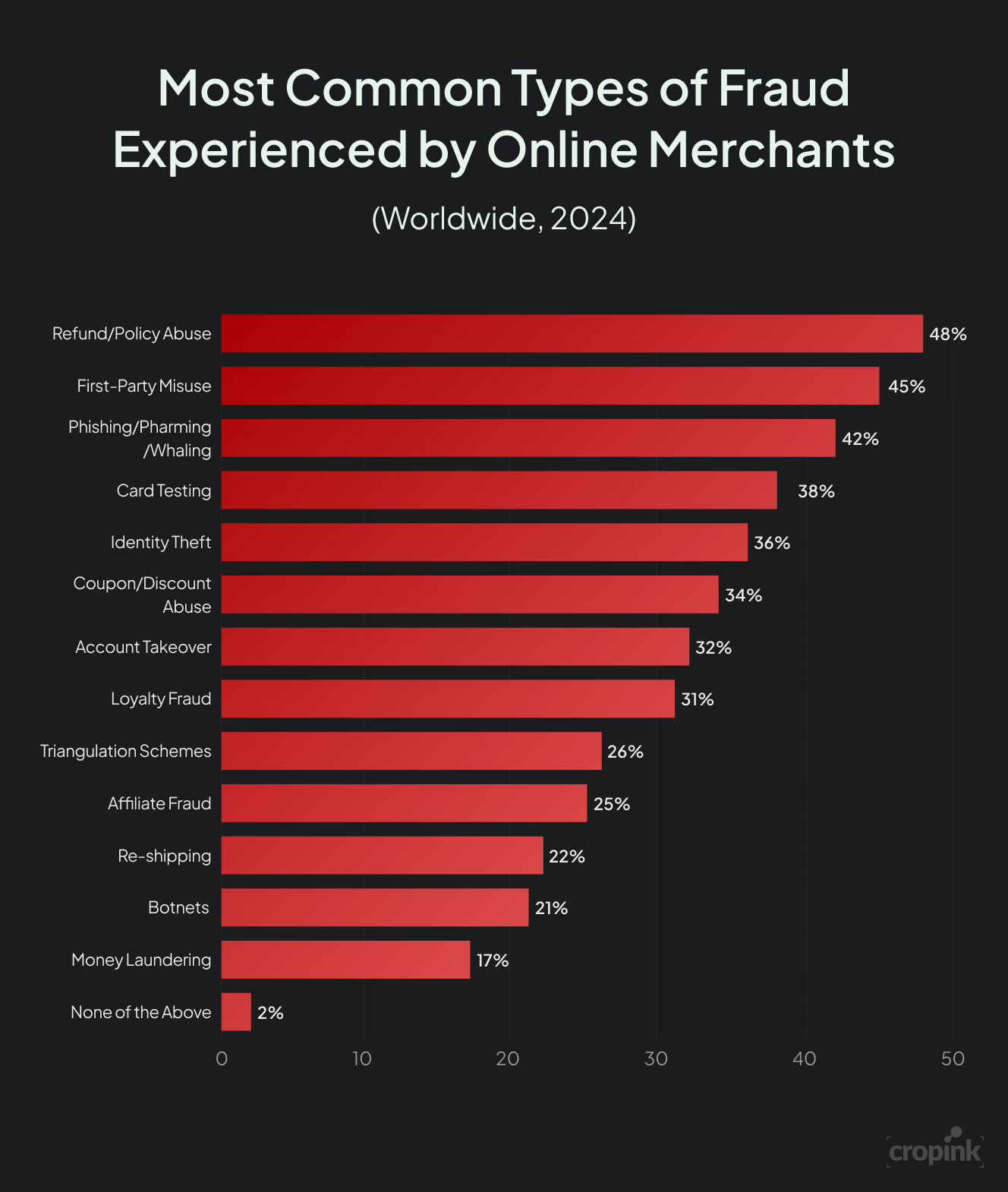

By 2024, refund and policy abuse became the most common eCommerce fraud, impacting 48% of global merchants.

Customers exploited lenient refund policies to keep products while still getting their money back.

Friendly fraud remained a massive issue, affecting 45% of merchants worldwide.

Unlike phishing or credit card fraud, these post-purchase scams happen after the transaction, making them harder to prevent.

Now, let’s uncover more eCommerce fraud tactics hitting businesses hard.

- Phishing: 42% of merchants were hit by phishing scams in 2024. Fraudsters tricked customers into giving up passwords and payment details.

- Identity theft: 36% of merchants faced identity theft in 2024. Criminals used stolen personal data for fraudulent purchases.

- Account takeover: 32% of merchants reported account takeovers, where hackers accessed customer accounts to steal funds.

- Credit card fraud: 38% of merchants experienced credit card fraud in 2024. Stolen card details were used for unauthorized transactions.

- Chargeback fraud: Disputed transactions led to massive losses. Merchants faced extra fees and penalties, increasing financial strain.

- Loyalty fraud: 31% of merchants saw scammers steal reward points and abuse loyalty programs.

- Affiliate fraud: 25% of merchants were hit by fake referrals and manipulated commission programs.

- Triangulation fraud: 26% of merchants reported criminals acting as middlemen, placing fraudulent orders with stolen cards.

- Botnet fraud: 21% of merchants faced automated bot attacks, creating fake accounts and testing stolen card details.

- Reshipping fraud: 22% of merchants were victims of reshipping scams, where stolen payment details were used to buy and reroute goods.

- Money laundering: 17% of merchants saw fraudsters using online transactions to move illicit funds.

Cost of eCommerce fraud

eCommerce fraud is getting more expensive every year. Global losses jumped from $17.5 billion in 2020 to $48 billion in 2023.

The rapid increase shows that fraud tactics are evolving faster than businesses can stop them.

Latin America loses 4.6% of total eCommerce revenue to fraud—the highest worldwide. Europe follows at 3.1%, APAC at 2.9%, and North America at 2.4%.

Even though North America has the lowest percentage, its massive market size means billions in losses.

Back in 2015, only 2.8% of global scams were related to online purchases. By 2023, that number exploded to 41.9%.

The proportion of scam victims losing money keeps increasing.

In 2015, 71.2% of online scam victims lost money. By 2023, that number hit 82.6%. Fraud tactics are becoming harder to detect, leaving more shoppers vulnerable.

Younger consumers aren’t the only ones at risk.

| Age Group | Percentage of Victims Who Lost Money |

|---|---|

| 18-24 | 76.6% |

| 25-34 | 76.5% |

| 35-44 | 77.3% |

| 45-54 | 75.4% |

| 55-64 | 69.3% |

| 65+ | 62.1% |

Websites are the biggest fraud hotspot, responsible for 36.7% of online scams. Social media scams are growing, making up 20.3%, while email fraud accounts for 8% of cases.

With fraud losses climbing and scams becoming more sophisticated, 2025 is shaping up to be another record-breaking year. If businesses don’t act fast, the cost of eCommerce fraud will keep rising.

Ai and eCommerce fraud

eCommerce fraud is surging, and AI is driving the rise. Global fraud losses are set to hit $107 billion by 2029, a 141% increase from $44.3 billion in 2024.

Fraudsters now use AI-generated deepfakes to bypass security and trick verification systems. Traditional fraud detection tools are struggling to keep up.

Fake AI-powered apps are also spreading fast. Over 50 fraudulent AI apps have been found stealing payment data through phishing attacks.

Fraudsters are using AI to outsmart outdated security. Businesses that don’t adapt will see rising losses. AI isn’t just the future of fraud—it’s the future of fraud prevention, too.

eCommerce fraud prevention market

With fraud losses hitting $48 billion in 2023 and rising, businesses are spending more to fight back.

Seventy-five percent of eCommerce companies plan to increase their fraud prevention budgets in 2025, with 20% boosting spending by at least 20%.

Only 5% of businesses expect to reduce their fraud prevention budgets, showing that most companies see fraud as a growing threat that requires stronger defenses.

Fraud detection tools are a must-have

The average eCommerce business now relies on five fraud detection tools to minimize risk. Among the most commonly used:

- Credit card verification services are used by 55% of eCommerce companies.

- Identity verification helps confirm customers and is used by 50% of merchants.

- Two-factor phone authentication adds an extra security layer for 44% of businesses.

- 3-D secure authentication is implemented by 39% to prevent unauthorized transactions.

- Internal customer order history checks help 34% of merchants flag suspicious activity.

Fraudsters are getting smarter, and merchants are using layered security measures to stay ahead.

Manual fraud screening is declining

While 19% of online orders are manually reviewed for fraud, the process is costly and inefficient. Only 3% of all orders turn out to be fraudulent, making manual checks time-consuming.

As a result, 63% of eCommerce merchants plan to reduce or eliminate manual fraud screening, while only 21% will keep it as a core strategy.

Two-factor authentication is the top fraud prevention tool

When asked about the most effective fraud-fighting tools, 61% of merchants ranked two-factor authentication (2FA) as their top choice. Other commonly used tools include:

- Device ID solutions (53%)

- Machine learning fraud detection (48%)

- Rules-based fraud prevention (45%)

- Behavioral biometrics (40%)

AI-driven fraud detection and behavioral biometrics are gaining traction as fraud tactics become more sophisticated.

Chargeback prevention is a major focus

Chargebacks remain a major financial burden, so 9 in 10 eCommerce merchants now use compelling evidence to dispute fraudulent claims.

With 72% of merchants aware of changes to credit card company chargeback rules, 89% believe these new policies will help them fight chargeback fraud more effectively.

Merchants are fighting back against account takeovers

Account takeover fraud is a growing issue, and 59% of eCommerce companies use CAPTCHAs to stop bots from breaching accounts. Other key defenses include:

- 46% use bot detection tools

- 38% require two-factor authentication

- 26% implement behavioral biometrics

eCommerce fraud predictions

As fraud tactics evolve, businesses must stay ahead of emerging threats. From AI-powered scams to biometric security, these predictions reveal what to expect in 2026 and beyond:

AI-driven fraud will dominate

Fraudsters are using AI to automate attacks at scale. Synthetic identity fraud surged 31% in 2024, while deepfake scams increased 28%. Expect AI-powered impersonation and identity fraud to grow even more.

Synthetic identity fraud will be a major threat

Criminals are using data breaches and AI tools to create fake identities for loans, accounts, and payment fraud. Verifying real users will be harder, putting pressure on businesses to improve security.

Deepfakes will make authentication tougher

AI-generated voices and videos are tricking businesses and banks. High-value transactions and account takeovers will become harder to detect, making real-time fraud prevention essential.

Real-time fraud detection will be critical

Fraud is moving too fast for manual checks. AI-powered fraud detection will be a must-have for businesses to analyze transactions in real time and stop fraud before it happens.

Payment scams will evolve

APP fraud and ACH fraud will rise as faster payments reduce detection time. Merchants and banks will need to monitor inbound transactions more aggressively to avoid heavy losses.

Liability shifts will increase financial risk

Regulations will push fraud liability onto businesses and banks. Companies that don’t invest in stronger security will be responsible for the losses.

Biometric authentication will become standard

Passwords are no longer enough. More businesses will turn to fingerprint scans, facial recognition, and behavioral biometrics for fraud prevention.

Fraud is changing—businesses must keep up

AI, deepfakes, and synthetic identities are reshaping fraud. Companies that fail to adapt with real-time AI security and biometrics will face rising losses in the years ahead.

Final thoughts

eCommerce fraud is evolving fast, and businesses that don’t adapt risk major losses. AI-driven scams, chargeback fraud, and identity theft are becoming harder to detect.

- Global fraud losses will hit $107 billion by 2029, a 141% increase from 2024.

- Refund abuse, synthetic identities, and account takeovers are rising fast.

- Stronger fraud prevention strategies are now essential for businesses.

Staying ahead starts with understanding eCommerce fraud statistics. Cropink helps brands create, optimize, and scale ads that drive results. Start for free today!

Sources

- Juniper Research. eCommerce Fraud to Exceed $107 Billion in 2029

- Exploding Topics. 23+ eCommerce Fraud Statistics

- Mailmodo. 19 Surprising Ecommerce Fraud Statistics

- Statista. Types of fraud causing the most losses to e-commerce merchants in the United States, by customer journey stage

- Statista. Most common types of fraud experienced by online merchants worldwide

- Stripe. Online and ecommerce fraud statistics that are predicting the future of fraud

- Electro IQ. E-Commerce Fraud Statistics By Revenue, Merchants and Facts

- Mitek. Fraud predictions: Industry innovators share bold forecasts for the future of fraud and identity

- NICE Actimize. Fraud Forecast: NICE Actimize's Top 5 Global Fraud Predictions

Ansherina helps brands create powerful digital marketing and performance marketing strategies. With a passion for ad design and audience engagement, she is dedicated to making brands more visible and impactful.

Leszek is the Digital Growth Manager at Feedink & Cropink, specializing in organic growth for eCommerce and SaaS companies. His background includes roles at Poland's largest accommodation portal and FT1000 companies, with his work featured in Forbes, Inc., Business Insider, Fast Company, Entrepreneur, BBC, and TechRepublic.

Related Articles

How Can Cropink Help?

Start with Cropink is easy and free

No credit card required